As various industries transition toward more electrified solutions, they are requiring motion control devices which are efficient and precise which is driving increased use of electric actuators (also referred to as electromechanical actuators).

By using electric actuators in place of hydraulic or pneumatic components, various benefits can be achieved which aid this transition including reduced energy consumption and improved position accuracy. In addition, there are safety advantages such as the elimination of fluid leaks.

Power & Motion spoke with Tom Diedrichs, Product Manager Actuators at Ewellix, about current trends in electric actuator designs and how he sees the market advancing in the coming years.

*Editor’s Note: Questions and responses have been edited for clarity.

Power & Motion (P&M): What trends or market factors do you feel had the largest impacts on electric actuator designs in 2023? Please explain what those trends are and how specifically they impacted the design of electric actuators?

Tom Diedrichs (TD): I would say there are several market factors that have impacted the design of electromechanical actuators in 2023.

One of the first I would say is the electrification trend we are seeing and the move from internal combustion engines (ICE) to electric drivetrains and batteries. With this we have a need and push for improved efficiency and energy usage. Before when using an ICE, you had the luxury of not really having to care that much about efficiency. Going to an electric drivetrain and relying on batteries you really need to optimize energy use to be able to achieve a full day of operation on battery power.

The second thing I would say is that there is a general push for hydraulic replacement in all types of applications that see value in the benefits that electromechanical actuators bring. This is of course efficiency [and] energy use [as well as] customers [striving] for higher productivity, better position accuracy and motion control at full speed to achieve higher quality production, shorter setup time and more flexibility in their production.

We have customers that also want to invest [in] reducing their total cost of ownership (TCO) and moving to electromechanical actuators they can reduce their TCO when factoring in the higher uptime, reduced energy cost and reduced maintenance cost. Electromechanical actuators are virtually maintenance free, something that brings a large value in many applications by not having to shut down for maintenance.

Then we also have the environmental aspect. We all know that we need to reduce our carbon footprint; this is the drive behind the global electrification trend we are seeing. But we can also eliminate contamination risks from hydraulic leaks that is both an environmental concern [and] often a safety risk and can often be very expensive and tedious to clean up.

Finally, we also have the safety aspect of a hydraulic replacement. Not having any fluid under pressure is an obvious benefit. The harm a broken hydraulic hose or fitting can do is scary. With electromechanical actuators you can completely eliminate this risk.

The third thing I would say we are now starting to see is high-performance electromechanical actuators being designed for high volume, with smart design driving down the cost and enabling mass adoption.

Before, we have mainly been able to sell electric actuators to more niche applications and for prototype adoption, but now we see a real mass adoption in all types off sectors, from mobile machinery to assembly automation and of course in medical applications where it has been the most common solution for a long time. This mass adoption requires an efficient design in the manufacturing of the electromechanical actuators.

READ MORE: The Basics and Benefits of Electromechanical Actuators

P&M: How have you seen electric actuator designs evolve in recent years?

TD: You can divide it up into two groups, depending on what type of electric actuator you are looking at.

For actuators with slow speed, simple motion and intermittent operation, meaning the actuator is moving a maximum of 10-25% of the time – at Ewellix we call these actuators low-duty actuators – we see more and more smart actuators with integrated controllers, integrated electronics, allowing the customer to control the actuator with a low current command without the need for an external controller. They often come with built-in absolute position sensors [and the] ability to adjust the end position within software whereas before you often needed to manually move an external limit switch that was difficult to adjust correctly and was subject to failures and bad readings.

And to be honest, with most actuators you couldn’t even move the limit switch so you basically got what you ordered.

These smart actuators also allow for parallel movement at full speed. We, for example, allow for up to eight actuators to move at full speed, enabling us to lift high loads with the same actuator. They also come with built-in condition monitoring. These are just some of the features these smart actuators are coming with in the low-duty range.

The end result of these smart actuators is that they are easier to integrate and easier to control, enabling higher productivity and flexibility. And by putting the controller inside these actuators, we eliminate the need for an external controller and save costs for the customer.

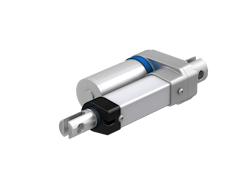

On the other hand, for the high-performance actuators used for more demanding applications with higher speeds (over 1 m/s), higher loads – we have some actuators that go up to 500,000 N – they often are requiring very high accuracy and often also move 100% of the time without stopping.

For these actuators we see a push for higher and higher power density, meaning higher load capacity in a smaller and smaller package. This is mainly driven by the need to replace hydraulic cylinders. Today, these actuators have a modular design, bringing value to the customer by allowing us manufacturers to deliver a customized solution from a modular platform in a [faster] and more cost-effective way.

But one of the main things is that these high-performance actuators are now being designed for high volume and low cost as well, something we have not really seen before.

P&M: What are some of the key features or performance attributes your company is working to include with its electric actuators, or for which customers are asking?

TD: We are investing a lot in our R&D (research and development) to be able to have the best possible actuators on the market. I can share four things we are currently working on.

The first is our SmartX platform. This is a range of smart actuators and lifting columns with built-in electronics. One example is our effortless column, where we take a column and integrate a load sensor, and from there read out a force input from the user and convert this into a speed command. This enables us to offer either a floor- or ceiling-mounted pillar for high loads, but they behave as a normal manual column without any electronics for the end user, so it’s super intuitive to operate.

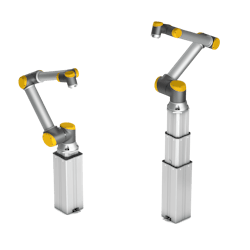

Second is our software integration with our collaborative robot partners, allowing a plug-and-play solution for a 7-axis extension, both horizontal and vertical, for collaborative robots.

Third, we are working hard to design the next generation of actuators that are designed for high volume and lost cost with the target of being able to replace hydraulics at the same cost. That is an ambitious goal, but I can say we are not that far from [reaching] this goal, and it will really open up a lot of new opportunities for us.

Finally, we are also working on our core technology to have the best possible ball screw and roller screw technology so we can deliver the best performance with the highest power density and lowest cost for our customers.

P&M: You were touching on it already but how much are you seeing electric actuators taking the place of hydraulic or pneumatic components or systems? Can you offer some examples, and how you possibly see this trend progressing?

TD: Yes, this is something we see strongly that electric actuators are taking the place of hydraulic and pneumatic solutions. One thing we can see is that all the major hydraulic and pneumatic companies now all have a range of electric actuators in their portfolio. The reason they have it is they know that the market is moving in this direction and they don’t want to be left behind.

Another thing we can see is the market maturity level in different sectors and applications. Here we see a slow but very steady move towards electric actuators. I can’t really say we are seeing a move from electric actuators back to hydraulic or pneumatic. Different sectors and applications are at different maturity levels. But by studying these maturity levels, we can also get some indication of where the market is moving and what we can project is coming next.

If we take medical [as an] example, I would say it’s almost a fully mature market. You will have a hard time finding a hydraulic or pneumatic cylinder in a hospital today. This has been the case for many years.

[In applications such as] servo press or plastic injection molding, here we see a lot of fully electric solutions and also hybrid solutions. The benefits of higher accuracy and better control with electromechanical actuators are quite obvious in these applications. I would say we are at a medium level of maturity; some axes are fully electrified, and some are not.

If we take the other side of the spectrum [and look at] mobile machinery as an example, here we are at an early adoption phase. But there are certain applications and work functions that are much further ahead. In agriculture, and specifically combine harvesters, that’s one example where we are seeing certain auxiliary functions have already been electrified by the leading manufactures for a few years now.

One of the most challenging and difficult applications for electromechanical actuators is excavators; they have high shock loads that are generated when digging, especially in hard dirt or if hitting rocks. But even here in the most challenging application, we are seeing the excavator OEMs are already today testing electromechanical actuators for the future.

This transition is not something that is going to happen overnight, but we see it is coming in all types of applications, even the ones that were way out of question just a few years ago.

P&M: Do you foresee any new trends or market factors impacting electric actuator designs in the coming year or years? If so, what are those and what impact will they have?

TD: I think we will see new actuators designed for harsh outdoor environments in applications today that are driven by ICE that will move to electric drivetrains and battery power. Electric actuators will be one of the key enablers for this transformation.

These actuators must be designed for high volume and low cost.

I also think we will see more smart actuators with built-in electronics, enabling new functions and a plug-and-play [solution] to make it easier for the end user to integrate and operate.

P&M: Are there any economic/market factors you are concerned could negatively impact the electric actuator industry in the coming year?

TD: It’s an interesting question and hard one to answer, but I would say the global economy will impact the speed of adoption, so if we have a slowdown in the global economy, I foresee we will have a slowdown in the adoption of electric actuators. But I do not foresee that it will stop this adoption and transition.

P&M: To help cap off our conversation, how do you see the electric actuators market in general performing in 2024 and beyond?

TD: We see a market that is growing, we foresee the market will grow next year [due to] a few factors. First, we are seeing a lot of R&D investment from OEMs. These are significant and we see these investments will generate growth in the coming years. We know there are several new projects that are being developed and launched in the coming years, so that will drive more volume for electric actuators.

On the other hand, we have an economy now that is kind of unstable and if we continue to have a slowdown in the economy next year, I foresee we will have a further destocking from our customers. We will have a slower order intake [and] we will have to work harder to get the orders in. This is something we have seen before in market uncertainties.

A lot of this is also partly driven by the increasing interest rates. It’s expensive to keep components in stock. The shorter the lead times are, the less you need to place orders far in the future. For us this means that we need to be more agile, and we need to be able to deliver products to our customers quicker.

I foresee a bright future ahead; if the market slows down that will affect us but I don’t really see it stopping the large investments from several large OEM companies which are really driving this [transition to electric actuators].