Data from research firm Interact Analysis indicates rapid growth over the next 5 years for the mobile robot components market. This sector is predicted to reach a value of $7.4 billion by 2027, achieving a compound annual growth rate (CAGR) of 44.8%.

Increasing use of mobile robots in a variety of industries is driving demand for the components which enable their operation including controllers, sensors, actuators – usually motors – and power systems, namely batteries.

Interact Analysis is forecasting high levels of growth for each of the component sectors which serve the mobile robots market.

Components with Strong Demand Potential

Although Interact Analysis is projecting strong revenue potential for all component sectors serving the mobile robot industry, there are some forecast to experience higher levels of growth than others.

The drivetrain component segment in particular is benefitting from current market conditions. This portion of the market is experiencing higher revenues due to supply chain constraints enabling manufacturers to charge higher prices for their products. Interact Analysis anticipates the drivetrain component market to be worth a value of $4.5 billion by 2027 because of the growing adoption of mobile robots and the increased average selling price for these components.

Lidar sensors are expected to account for a large portion of the components market as well because of their growing use for navigation in mobile robots. “The growth that we expect to see for navigation componentry is overwhelming. Revenues for this area of the market currently sit at $253 million and this will grow at a CAGR of 33.1% to over $1.4 billion by 2027. Much of this revenue growth will be generated by sales of lidar sensors due to their higher unit cost compared with other types. In 2021, lidar sensors accounted for 65% of revenues for the navigation component market," stated Brianna Jackson, Research Analyst at Interact Analysis, in the firm's press release summarizing its findings on the mobile robot components market.

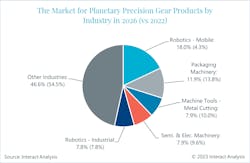

An earlier report from Interact Analysis indicates the mobile robots market will be a growth sector for the precision gear products market. Increased automation and implementation of robotics has benefitted the precision gearboxes and geared motors market in recent years due to their use within the motion control systems utilized in these applications.

READ MORE: Steady Growth Expected for Motion Controls Market

Precision planetary gearboxes are more commonly used in mobile robots, and their market value is expected to rise due to the growing use of these robots. Although packaging machinery has been the largest customer segment for these gearboxes, Interact Analysis predicts mobile robots will take over that position and account for 18% of the market by 2026. Sales for planetary gear products will achieve the fastest rate of growth in the mobile robots market with a CAGR of 55% through 2026 predicted.

Market and Regional Factors Making an Impact

Strong demand for order fulfilment robots is driving much of the market growth for mobile robots and their components according to Interact Analysis. In particular, shelf-to-person (S2P) robots are the dominant type being purchased in large part because of Amazon's use of these machines and influence on the market. As other companies look to mirror the logistics giant, they too will adopt S2P robots which will aid their continued market growth.

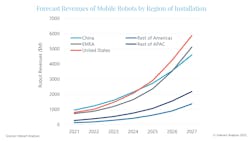

Interact Analysis cites the U.S. as the dominant region for mobile robot component sales. This is due in part to the market created by Amazon's production of its in-house fleet of mobile robots. The U.S. is expected to remain a dominant region for the components market in terms of revenue, but China is expected to become a stronger rival in the coming years.

China is forecast to overtake the U.S. in unit sales by 2025 for the mobile robot components market. According to Interact Analysis, China will account for over 40% of the market by 2027. Development of robots and their necessary components in this region is helping to bring down their costs, particularly for navigation systems said the research firm.

Given the majority of mobile robots for manufacturing and logistics come from China, other regions in Asia Pacific (APAC) will likely not account for as much of the mobile robot components market.

Mobile Robot Market Growth to Benefit Component Demand

Additional research from Interact Analysis shows the mobile robot market itself is expected to achieve a CAGR between 30 and 40%, and reach over 4 million installed units by 2027, which will of course benefit the components market which serves it. Manufacturing will continue to be a key driver for this growth, while new applications will aid market growth as well.

Both of the most common types of mobile robots, autonomous mobile robots (AMR) and automated guided vehicles (AGV), will see strong demand over the next 5 years but AMRs will be the frontrunner due to their ability to be used in more applications.

READ MORE: Autonomous Mobile Robots on an Upward Trajectory

Logistics alongside manufacturing applications will be the sectors with the largest adoption rates as they look to overcome labor challenges through automation of various tasks to remain productive.

S2P robots will contribute to market growth in China and other Asia Pacific (APAC) regions. Order fulfilment robots are expected to be the dominant player in the Americas and EMEA (Europe, Middle East and Africa); these regions are also forecast to bring the largest growth opportunities with the U.S. alone accounting for almost $6 billion in 2027.

Revenue growth in the APAC regions is expected to be slower because of the lower average selling price for mobile robot technologies but China will still account for about 40% of shipments over the next 5 years because of efforts there to automate operations.

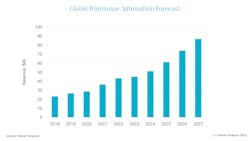

Efforts to deploy automation in the warehousing sector will also benefit the mobile robots market. According to Interact Analysis, installation of mobile robots have accounted for a large portion of automation efforts in warehousing, and is expected to encompass 30% of warehouse automation revenues by 2027. The overall warehouse automation market is forecast to achieve a CAGR of 13% through 2027.

"Although mobile robots are thought to be displacing fixed automation alternatives, this isn’t necessarily the case. They are often opening up new market opportunities, which would otherwise have remained manual. This type of technology is best suited to situations that require flexibility and scalability, whereas fixed automation is more appropriate in scenarios where increased throughput is the main goal," said Rueben Scriven, Research Manager at Interact Analysis, in the research firm's press release summarizing data from its warehouse automation report.